While yesterday’s rout was certainly nerve-wracking, it appears that technical damage was relatively contained on most measures. At one point, the S&P 500 broke below its longer-term 200-day moving average. However, it managed to finish above that level by the end of the day. Other measures like advance/decline lines and new 52-week lows were moderately worse on the day, but don't appear to be flashing alarming warning signals at this point.

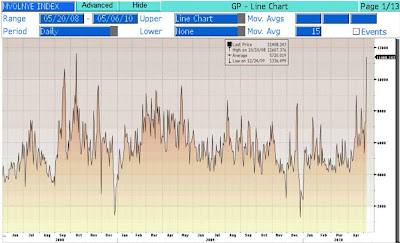

There were a couple of measures that suggest that there may have been too much fear in the market yesterday – total volume on the NYSE reached 11.4 billion shares, very close to the levels hit in the fall of 2008, just after the collapse of Lehman Brothers, and about a year into a bear market that had already seen a 20%+ decline in stocks! In addition, the VIX Index, which measures the volatility of options prices and is widely viewed as a “fear” indicator, rose to 41, which was the highest level since last May, almost exactly a year ago.

In short, while there may be more volatility ahead as the Greek crisis continues to capture headlines, we believe yesterday’s sell-off may have been overdone, and are staying the course for now.